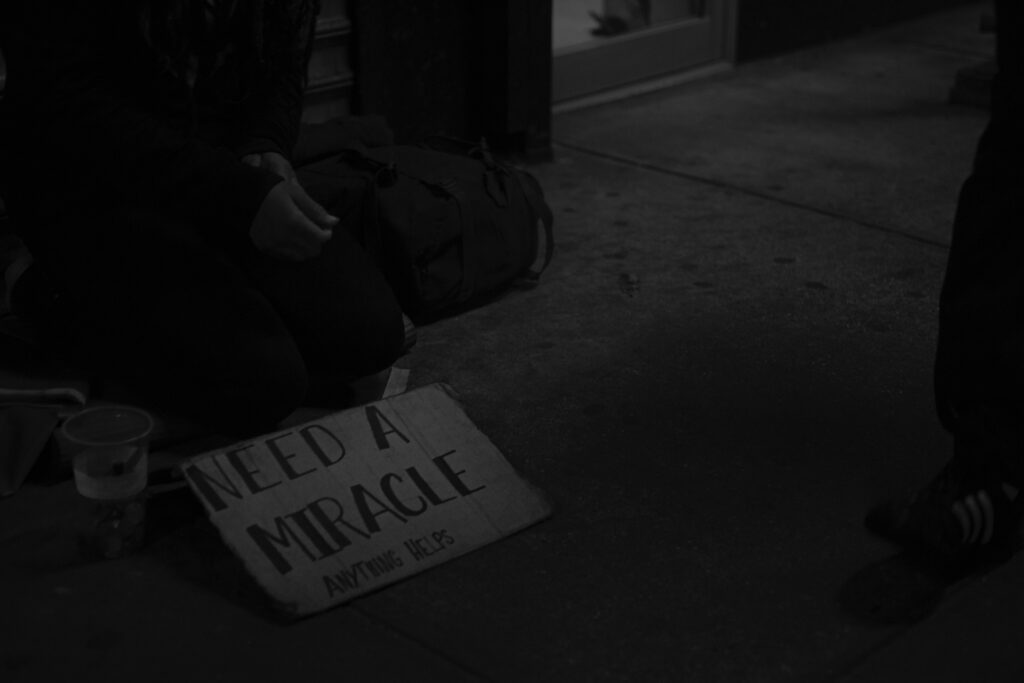

Are you heading to financial disaster?

Are you heading to financial disaster? Continue reading to find the top 3 financial warning signs. At Budget Build Buy we are here to help you no only identify them but also avoid them.

You struggle to make payments each month

If you can barely make your payments now, think about whats going to happen if you’re running short on cash. Barely making the minimum payments will not only cost you more but it will make your debts feel like they will never go down. Learn how to use credit but never ever pay a single dollar of interest. It takes discipline and sticking to a budget.

Relying on credit for every day purchases

Credit isn’t an extension of your checking or savings account. If you have to treat it that way, that’s a sign that there are some major issues with your cash flow. At Budget Build Buy we teach you how to leverage cash rewards and other benefits for your financial gain. However, those strategies are only successful if you pay your balance in full each month. To comfortably pay your balance each month you should only spend on credit cards less than what you make.

Depending on grace periods to avoid late fees

Grace periods allow you to pay your bill after the due date without a late fee. If you find yourself relying on grace periods to pay your bills, it means you’re already unable to pay your bills. Furthermore, you are dangerously close to missing a payment, a critical factor in how our credit scores are calculated.

Are you heading to financial disaster?

If you are struggling to make payments each month and can usually only make the minimum payment you might be heading towards financial disaster. Do you use you credit to pay for groceries but don’t pay the entire balance off each month? Then those groceries will cost you a lot of interest in the long run. Are you close to missing payments or have missed payments on occasion? If you are using grace periods to make your payment you are heading to financial disaster.

If you’re experiencing any of these signs, you may be under too much financial stress. It’s important to address it before you start falling behind on payments. Once you start falling behind, your credit score will take a hit. And a lower score will make it harder to get approved for any financing.

Contact us about your situation and we can help outline your possible solutions. We have debt consultants available to assist you.