Easy Budgeting Tips to Achieve Your Goals

Easy Budgeting Tips to Achieve Your Goals Just do it, a journey of a thousand miles begins with a single step. When looking at your finances and your long term goals (goals 12-24 months or more away) the road seems long and impossible. Take the first step and initial action. That small step has you […]

How to determine the retirement savings need

How to determine the retirement savings need How to determine the retirement savings need is a critical part of establishing long term retirement goals. We will break this down into retirement income needs and various income sources. Income needs Retirement income need is the dollar amount needed to support a desired lifestyle. quantifying this need […]

Cheat Sheet for Complex Retirement Terms

Cheat Sheet for Complex Retirement Terms Cheat sheet for complex retirement terms this cheat sheet will help you better navigate the complex world of retirement planning. Deductible IRA. An individual retirement account that allows the owner to deduct the amount of the contribution from current federal income taxes. Deferred compensation. Income that is not currently […]

How to withdraw funds from your IRA penalty free

How to withdraw funds from your IRA penalty free How to withdraw funds from your IRA penalty free is one of the most common questions we receive on a daily basis. But what is an IRA? An IRA or individual retirement account is a special custodial or trust account implemented through brokerage firms, banks, insurance […]

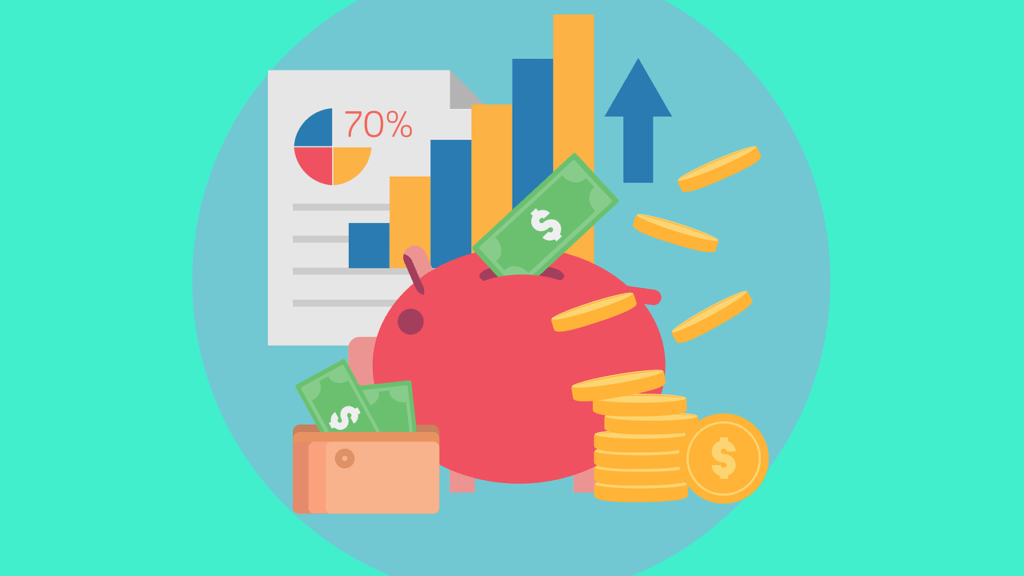

Income Replacement Percentages

Income Replacement Percentages Income replacement percentages during retirement are used by planners as rough guides in determining the amount of income needed in retirement, using preretirement income as a base value (100%). Thus, it is common to hear financial advisors myself included to state that retirees need 85% of preretirment income to support a similar […]

Save Early and Often

Save Early and Often Save early and often – it is likely that the majority of young households will have little discretionary income each month, and the tendency is to put off saving. When you are young, and have your first real job, probably the last thing on your mind is retirement. Then, before you […]

How to Calculate a Retirement Savings Need

How to Calculate a Retirement Savings Need How to calculate a retirement savings need is a critical part of establishing long term retirement goals. We will break this down into retirement income needs and various income sources. Income needs Retirement income need is the dollar amount needed to support a desired lifestyle. quantifying this need […]

Understanding Retirement Terms

Understanding Retirement Terms Understanding retirement terms will help you better navigate the complex world of retirement planning. Deductible IRA. An individual retirement account that allows the owner to deduct the amount of the contribution from current federal income taxes. Deferred compensation. Income that is not currently payable to an employee but that is payable in […]

Determining Your Retirement Goals

Determining Your Retirement Goals Determining your retirement goals comes after the previous steps of analyzing cash flow statement and balance sheet. I like to start by talking to my clients about their visions of retirement, their goals, and their values. Picture a day in retirement. Will it involve pure leisure and hobbies, or maybe some […]

Assets Liabilities and Net Worth

Assets Liabilities and Net Worth Assets liabilities and net worth reveal your financial position as of a specific date, and they are used to construct the personal statement of financial position, or “balance sheet.” Such a statement is a good measure of financial health and will help you identify what assets may be available to […]